Bitcoin, cryptos and blockchain

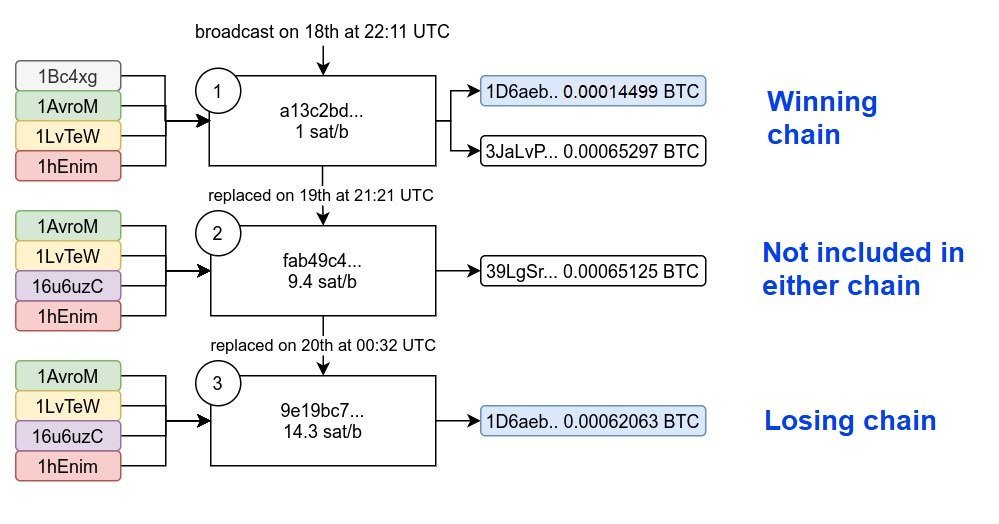

The world woke up to a drop in Bitcoin’s latest and most impressive rally to date on the 22nd of January, 2021. The reason was a report of a possible Bitcoin double spend. The technicalities of the proof or disproof make for a very educational read, nonetheless, in this article instead of focusing on the details as in the image below, we will take this opportunity to discuss the much bigger picture of bitcoin, blockchain and other cryptos.

The ‘double-spend’ transactions (Source: BitMEX Research)

Bitcoin and blockchain

For many people, their understanding of Bitcoin and blockchain is a mix of a) Bitcoin is one and the same as blockchain or b) they believe they understand Bitcoin while not understanding blockchain. This is an easy perception to correct with 3 simple facts

- Blockchain is a technology, the same way the battery development in 1800 was a new technology that today is so ubiquitous that it is almost invisible to us. We chose the battery technology example, as we believe blockchain is a technology that is already becoming as widespread as batteries.

- Blockchain is a database technology, and it derives its name from records, called blocks, that are linked using cryptography, a chain. While blockchain is a database, a database is not a blockchain. This is because by its design, a blockchain is resistant to modification of the data by being an open, distributed ledger that records transactions in a self-verifiable and permanent way.

- Blockchain’s technology first application was the Bitcoin, on the 3rd of January 2009, introducing the world to the first decentralised digital currency, the first cryptocurrency. Since then many more blockchain have been developed for all kind of different uses from other cryptocurrencies to applications in healthcare, in banking, in accounting and so on.

Therefore, Bitcoin was the first use case of the blockchain technology, which is a database technology that allows for unalterable permanent record creation and has potential application in virtually every aspect where such features are of value. Blockchain technology is here to stay and we consider the story of its development as beautiful (and mysterious) as the story of the proof of Einstein’s Theory of General Relativity

Bitcoin, the double-spend and other cryptos

There is a debate as to what Bitcoin represents. Is it a cryptocurrency and is here to replace government issued and controlled currencies? Or is it the digital analogous to gold and thus a commodity to store value? There is no reason conclude the debate so early – remember Bitcoin has only been around since 2009.

Our opinion is that Bitcoin is not and it will not become a cryptocurrency. This does not mean you cannot pay with Bitcoin, as you can. It means that it fluctuates enough, for those who believe in its upside to wish to hold it and pay with something else, and those who are neutral or believe in its downside to avoid accepting it as a form of payment.

This brings our view of bitcoin to that of being a digital asset that may be seen as digital gold. Again, the answer will be given one test at a time, and the recent double-spend news is another test to the many that Bitcoin has so far successfully passed.

Regarding other cryptos such as Ethereum, we hold a variant of the same view. All these blockchains are built and others are being built with a different application in mind. Whether they will actually reach the status of cryptocurrencies remains to be seen and we suggest keeping an open mind to our stance here. We believe the many different Central Bank Digital Currency (CBDC) projects underway will mature rapidly in 2021 and we also believe that crypto-currencies are better referred to as crypto-assets, which is in line with the Regulation on Markets in Crypto Assets (MiCA), a pan-European regulatory regime for crypto-assets and related services.

Crypto-assets then can mean digital shares, digital bonds, which is what the whole buzz around security tokens and asset tokenisation is about.

Blockchain, security tokens and asset tokenisation

In late 2019, we authored an article titled Security Tokens and Asset Tokenisation in 2020, in which we called security token offering (STO) the absolute game-changer and anticipated 2020 to be the year where digital assets would mark their ground-breaking contribution.

Before we explore whether we were proved right or wrong, let’s take a step back to define three key concepts:

- Asset tokenisation is the process of converting ownership rights in a particular asset into a digital token on a blockchain.

- Security token is the digital token on the blockchain that represent ownership rights in the tokenised asset.

- Security token offering (STO) is a public offering in which security tokens are sold on a security token exchange.

Now, back to our statement for security tokens in 2020. According to data from the Security Token Market:

- Total Trading Volume in January 2020 was $193,796 and in December 2020 $2,695,419.32.

- Total Security Token Market Cap in January 2020 was $54,723,057 and in December it reached $374,061,074. This is an increase of 584%, a growth of nearly 6 times.

It looks like 2020 has indeed been a year of tremendous growth for asset tokenisation, security tokens and STOs. Beyond the numbers above, many regulatory developments such as the Liechtenstein Blockchain-Act took place, joining the initiative by a number of newly founded firms that cater for different aspects of the asset tokenisation and security token offering process.

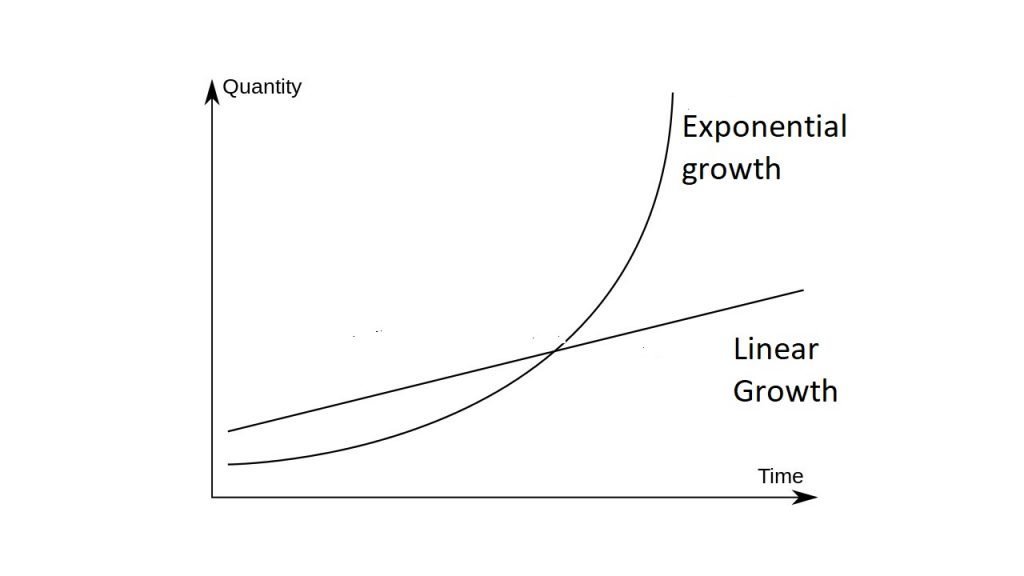

As per the image below, we expect that 2021, 2022, and 2023 will form the middle part of the exponential growth curve, and STOs will eclipse traditional IPOs (initial public offering) by the end of this decade.

2021: Anti-money laundering, KYC/KYT and investment funds

Two new European directives on anti-money laundering (AML) were introduced in 2020

- the fifth AML EU Directive (AMLD5)on the 10th of January 2020, and

- the sixth AML EU Directive (AMLD6) on the3rd of December 2020.

This to us is the most convincing indication that regulators are not ignoring the crypto-ecosystem anymore and are preparing for its widespread integration into our everyday life be it as crypto-currencies, crypto-assets, security tokens, Bitcoin, and other blockchain applications.

In 2021, we expect

- more institutional interest in crypto assets along investment funds dedicated to cryptos to be launched. This is both, due to the rise of Bitcoin, and because of the AML directive we mention above.

- the use of blockchain to grow exponentially, especially as the coronavirus pandemic has accelerated the digital transformation in all aspects of commerce, finance and everyday life.

- the CBDC projects by a number of nations will accelerate, including a decision by the European Central Bank (ECB) on the digital euro by mid-2021.

Our expectations are not limited to the three bullet points above, however we need to keep some of our thoughts private. Nonetheless, the conclusion we can openly share with you is that we are at the infancy of an extremely rare event where a new asset class is being created.

We translate this to the plural of one word – opportunities.

If you are interested to know more, ask clarification, or discuss a relevant project on bitcoin, cryptos, asset tokenisation or an STO, please contact us at info@salvusfunds.com.

#StayAhead

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.